Our last article, Amazon’s Empire, detailed the ways Amazon is poised to dominate e-commerce like never before. This article focuses on how companies like Facebook and Google could prevent a complete Amazon takeover.

There is one major, major area that Facebookers and Googlers can bolster in order to stay competitive with Amazon: Product Data.

Product Data

Google may know everything about its users and the campaigns advertisers run on Google, but they’re missing product-level business data, which dramatically influences the profit at the end of the day.

Facebook has a deep understanding of its users: likes, dislikes, amount of interest in talking like a pirate, etc. What they’re missing is… you guessed it: product-level business data.

Amazon, on the other hand, is able to granularly track every SKU at the product-level, gaining insight into variables like margin, stock-level, chance of return, and more.

While Google can track your number of conversions with ease, things get a lot clunkier when they need to analyze things at the product level.

EXAMPLE:

If one of Google’s retailers wants to analyze their data about product returns (something which requires product-level data), the retailer will need to go through a number of steps and imports.

Why is it so tricky? Both Google and Facebook were built to present data from the point of view of the campaign: all their marketing data and marketing actions (setting bids, budgets, etc.) are centered around the ad, the adset, or the campaign.

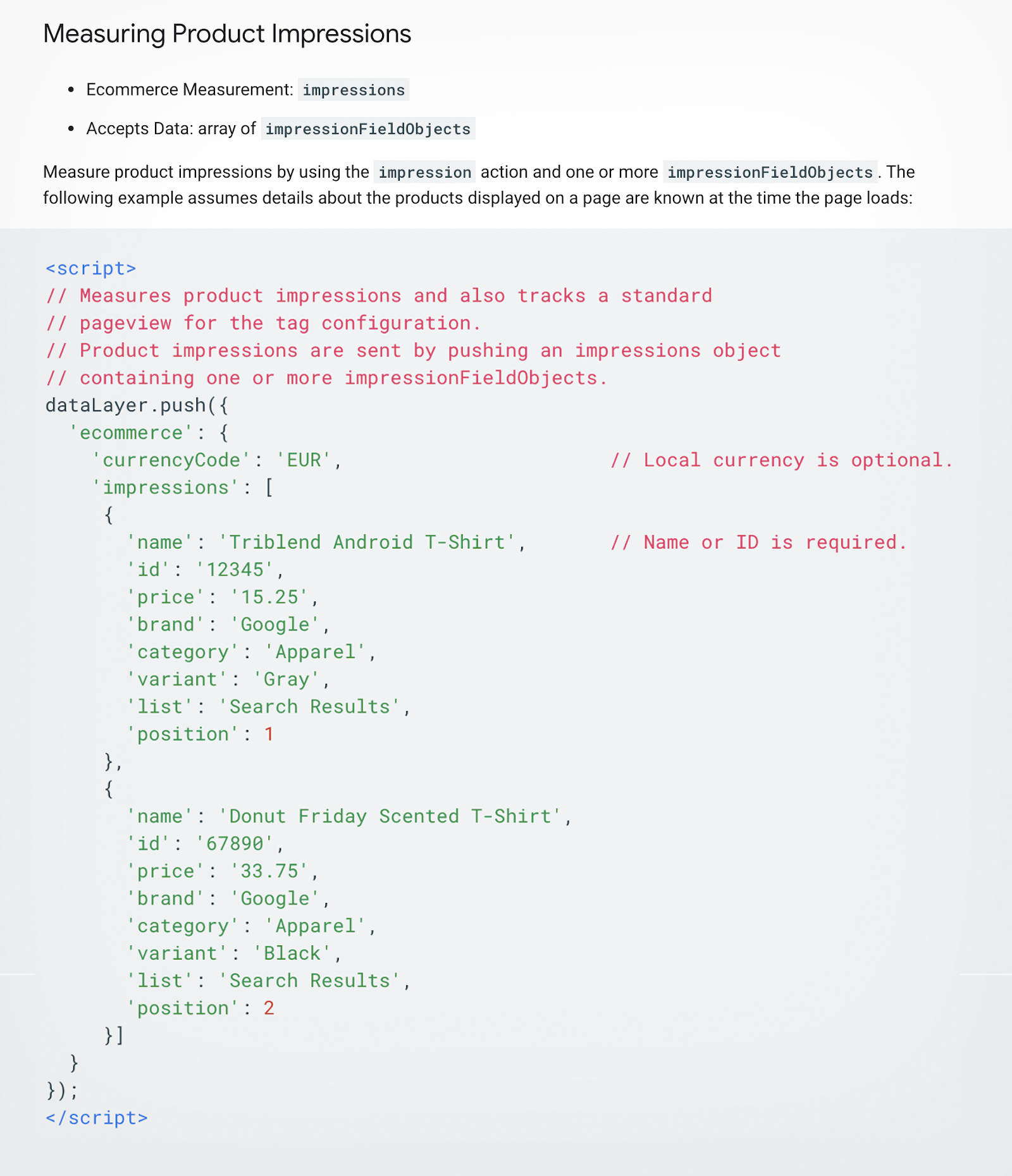

Google’s Enhanced Ecommerce method (pictured below) is their answer for product data; it allows users to track data around product impressions within Google Analytics. However, that data still won’t enable users to optimise their ads using product-level metrics.

It is difficult for both Google and Facebook to get this product-level business data because most retailers keep their data in different silos and formats; there’s a good chance that even the retailer’s marketing department wouldn’t have access to product-level margins, stock volumes, or other mission critical data.

But. Once we crack this challenge and create an additional layer connecting the world of campaign management with the reality of product-level retail, all sorts of things become possible.

- You can easily find your overall best-sellers

- You can find your most profitable items

- You can promote different products to different customer groups

- You can even create conditions to automatically promote best-sellers when you find them

- You can get even more advanced, and compare the number of impressions a product gets on Facebook with the number of sales it gets on Google to find products that Facebook’s algorithm is overlooking, and vice versa.

Precise Optimization

Facebook and Google have each developed incredibly powerful algorithms. While this article discusses certain limitations, retailers should be sure not to fall into the trap of thinking, “I can optimise it better because I know something that they don’t”.

We see that retailer data will always exist within different internal systems and marketing silos (and we certainly don’t think Facebook will share their data with Google, or vice versa, anytime soon). In order to clear this hurdle, we’ve found that retailers can use their product data to enhance the algorithms of Facebook and Google, increasing efficiency.

How it Works Now

Facebook and Google want to create wonderful experiences for their users, and profit for their advertisers

→ The more data they have about a product and can apply, the better they can estimate what is profitable for the advertiser to promote

→ The more a product is promoted, the more applicable data they have on how it resonates with users.

→ The more applicable data they have about a product, the more value they can deliver to both user and advertiser

This can become a feedback loop. When analyzing our client data, we found cases where 50% of total Facebook impressions were spent promoting as little as 1% of the retailer’s catalogue. This is an example of the Principal Agent problem: the agent (FB/Google) is in charge of making decisions on behalf of the principal (the retailer). If one decision is best for the principal, but another decision is better for the agent, it can create conflict.

Beyond that, retailers often have different optimization goals from those of the social networks (e.g. profitability vs engagement), which can result in even a retailer’s most profitable items being ignored.

There are ways retailers can add product data to incentivize Facebook to show the items they want, or influence Google Smart Shopping to do the same, but it’s not something retailers can easily do through Facebook or Google alone.

The Next Step

Amazon’s profit is almost entirely from AWS, and they still had $4 billion in operating income from just the first quarter of 2020. The machine is almost complete; once Amazon decides it’s time to turn it on and focus on profit, e-commerce will be a completely different landscape.

Right now, Amazon is investing that $4 billion from Q1 into their COVID-19 response. They’re investing all of it. Amazon does not take half measures.

With a $4 billion investment into health, safety, and processes regarding COVID-19, it feels safe to assume that Amazon will set the tone for the e-commerce response to coronavirus worldwide (if they haven’t already).

With this investment, Amazon will be able to position themselves to the world as the easiest and provably safest way to get goods during the rest of this pandemic, which will be of great benefit to their international business. Amazon is still spending billions a year growing the international segment. Once that becomes profitable, Amazon’s machine will be fully operational.

In order to compete, Google and Facebook will need to use the strongest weapon in the retail arsenal: product-level business data. Retailers can also take this fight into their own hands by enhancing the existing social algorithms with their product data. Either way, ROI Hunter can help make the connection. If you’re interested in learning more about how you can integrate your product data, click here to read more details, or here to speak with someone about the specifics of your company.